ALLY 3071 Joint 2013-2026 free printable template

Show details

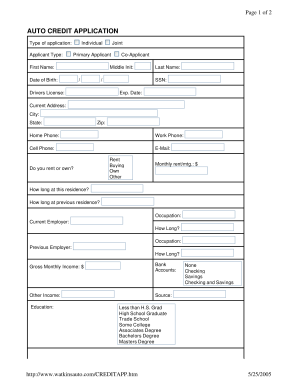

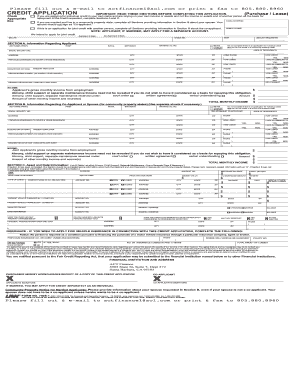

Ally. Application Type: Transaction Type: Dealer Number. 0 Individual 0 ... terms of this application including terms on. Page 2. Date. Date. Applicant's Signature.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ally credit application form

Edit your ally credit application pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ally credit app pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ally business credit application pdf online

To use the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ally form pdf. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ally credit app form

How to fill out ALLY 3071 Joint

01

Obtain the ALLY 3071 Joint form from the official source.

02

Read the instructions provided with the form carefully.

03

Fill in your personal information in the designated sections, including name, address, and contact details.

04

Provide any required identification numbers or documentation as specified.

05

Complete any sections that require specific details about the joint account or agreement.

06

Review all entered information for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form as instructed, either electronically or by mail, along with any necessary supporting documents.

Who needs ALLY 3071 Joint?

01

Individuals or entities looking to set up a joint account or agreement.

02

Partners in a business transaction requiring a joint financial arrangement.

03

Families or couples wanting to manage shared finances.

04

Anyone needing a legal document to formalize a joint financial relationship.

Fill

ally credit application form pdf

: Try Risk Free

People Also Ask about ally auto application form

What is the minimum credit score for Ally financing?

Minimum credit score needed for each mortgage loan type Type of LoanMinimum FICO ScoreConventional620JumboAbove 700FHA loan requiring 3.5% down payment580FHA loan requiring 10% down payment5003 more rows • Feb 13, 2023

What credit score does Ally Bank use?

Lenders use your FICO score to determine how you successfully you might repay a loan.

What is credit application form?

A credit application is a standardized form that a customer or borrower uses to request credit. The form contains requests for such information as: The amount of credit requested. The identification of the applicant. The financial status of the applicant.

What credit card company does not do hard inquiry?

For the purposes of this guide, I'll go through the best secured credit cards you can apply for that do not require a hard pull on your credit: OpenSky® Secured Visa® Credit Card. First Progress Platinum Prestige Mastercard® Secured Credit Card. Applied Bank® Secured Visa® Gold Preferred® Credit Card.

Does Ally credit card do a hard pull?

Editorial and user-generated content is not provided, reviewed or endorsed by any company. Yes, the Ally Platinum Mastercard® does a hard pull on your credit report when you apply for the card. A hard pull usually results in a slight decrease in your credit score, but the effect only lasts for a short period of time.

What credit score is needed for Ally?

What credit score do you need for an Ally Bank auto loan? You'll be eligible for better rates with a credit score of 620 or higher, but Ally has extended loan offers to consumers with credit scores as low as 520.

Does Ally Bank do line of credit?

Ally offers dealer loans for real estate, new equipment and working capital, as well as revolving credit lines to cover a variety of specific business needs and expenses.

What credit score do you need for Ally?

What Credit Score Do You Need? Ally typically requires a FICO score of at least 620. For jumbo loans, though, borrowers need a FICO score of at least 700 and a debt-to-income ratio of no more than 43%.

What credit score is needed for Ally financing?

What credit score do you need for an Ally Bank auto loan? You'll be eligible for better rates with a credit score of 620 or higher, but Ally has extended loan offers to consumers with credit scores as low as 520.

Is Ally Financial hard to get approved?

Ally Bank reports that you're "more likely to be approved" for their auto loans with a score of 640 or higher. There are user reports of being approved with a score as low as 600. Ensuring your revolving balances are low and that you have less than six inquiries will help.

What credit bureau does Ally pull from?

Ally financial pulls from all three major credit bureaus — TransUnion, Equifax, and Experian. What if your credit could use a little help?

Can you get pre approved through Ally Auto?

We offer terms ranging from 36 to 75 months. You can get prequalified to see what terms you're eligible for.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ally business credit application online?

The editing procedure is simple with pdfFiller. Open your ally credit app online in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit ally credit application fillable in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing ally business auto loan application pdf and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I complete ally financial credit application pdf on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your ally auto loan application. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is ALLY 3071 Joint?

ALLY 3071 Joint is a specific tax form used for reporting joint income and financial information by couples or partners who wish to file their taxes together.

Who is required to file ALLY 3071 Joint?

Couples or partners who are married or in a recognized civil partnership and choose to file their taxes jointly are required to file ALLY 3071 Joint.

How to fill out ALLY 3071 Joint?

To fill out ALLY 3071 Joint, taxpayers need to provide personal information for both individuals, report their joint income, deductions, and any applicable credits, and ensure all fields are completed accurately according to the guidelines provided by the tax authorities.

What is the purpose of ALLY 3071 Joint?

The purpose of ALLY 3071 Joint is to streamline the tax reporting process for couples by allowing them to compile their financial information together and potentially benefit from deductions and credits available for joint filers.

What information must be reported on ALLY 3071 Joint?

The information that must be reported on ALLY 3071 Joint includes both partners' names, Social Security numbers, total incomes, deductions, tax credits, and any other necessary financial data related to their joint financial activities.

Fill out your ALLY 3071 Joint online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ally Credit App Download is not the form you're looking for?Search for another form here.

Keywords relevant to ally loan application form

Related to ally financial credit application

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.