ALLY 3071 Joint 2013-2024 free printable template

Get, Create, Make and Sign

How to edit ally credit application pdf online

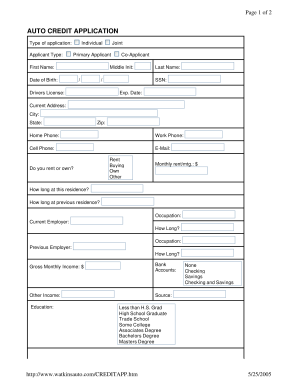

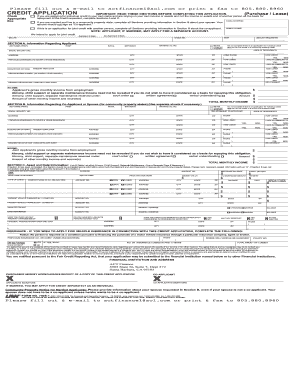

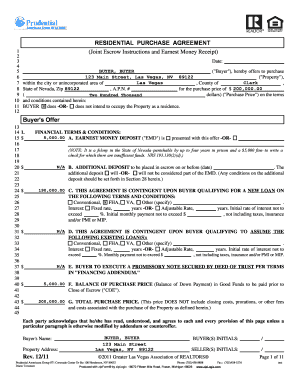

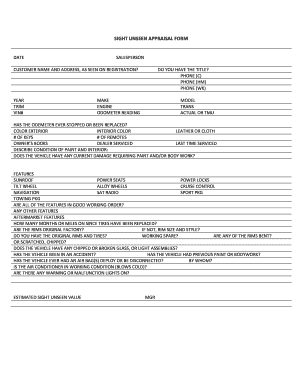

How to fill out ally credit application pdf

How to fill out ally credit application pdf:

Who needs ally credit application pdf:

Video instructions and help with filling out and completing ally credit application pdf

Instructions and Help about ally form online

On behalf of AFC first peoples gas North Shore gas nicer gas and came welcome to this information session about the Illinois small business energy efficiency loan program during this presentation will do a brief round of presenter introduction and then get right into discussing the features and benefits of anvil financing for your small business customers will also run through the process and requirements in order to apply for and obtain and financing for a small business energy efficiency improvement you'll hear from Bob regular at AFC first the lender providing customer loans within the came people's gas and North Shore gas small business energy savings program and the nicer gas small business energy efficiency program implementer Franklin energy services and necks and Inc also assist in the envelope is I'm Caitlin Dorsey from Franklin energy, and you'll be hearing a little later from Chris McKay that neck since we are all here to help you if you have any questions after viewing this presentation get in touch with any of us there are a number of resources available for trade allies to assist their customers in obtaining on your phone in Singh for their energy efficiency improvements these include an approved contractor application in checklist customer brochures are also available for each utility energy efficiency program these brochures can be a helpful sales tool in showing your customer how to combine energy efficiency rebase and envelope thing to pay for a project customer who are ready to apply for on dual financing may complete the customer commercial credit application, or they can apply by phone now I'll turn it over to Bob from AFC first to give you more details about on-bill financing thank Caitlyn um, so we're excited and about this new program that started a couple of months ago and just a quick overview about the envelope financing in general for the small business, so the envelope enhancement program allows small business customers to invest in a various energy efficient improvements and to repay these funds directly on their utility bill this is an opportunity for your customers to help them day for their part of the project costs, and we think it's a great asset and tool to encourage energy saving projects and improvements this is a new program that was introduced in January 2014 for the state of Illinois the new tool for multifamily and small commercial customers of came on the electrical side and nicer gas and people's gas and North Shore gas on the gas side so some benefits on the program it's a low rate low monthly payment financing for lighting HVAC and other energy-saving improvements part of the point of the program to help you drive your sales a small business energy efficiency improvements it is no cost financing for lighting HVAC and other energy-saving improvements no cost to the contractor and no cost to the customer to apply that's a great asset to you, and it works in conjunction with utility energy saving...

Fill ally credit app : Try Risk Free

People Also Ask about ally credit application pdf

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your ally credit application pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.